Can you guess what families with college-going teens are worrying about the most these days?

Students and parents say paying for college is their top worry, according to the Princeton Review’s College Hopes & Worries Survey Report and several other recent studies. With students and parents feeling this way, especially since the start of the pandemic, it’s more important than ever that we as teachers or counselors teach students how they can afford college.

Here are the main topics I’d start with:

- What Financial Aid Is

- Sources of Financial Aid

- Types of Financial Aid

- The Cost of College Attendance

- Applying for Financial Aid

I would suggest reviewing this information with students in an interactive presentation, rather than a lecture, preceded and followed by activities and discussion to ensure higher engagement and retention and students actually taking the needed steps to afford college.

What Financial Aid Is:

Financial aid is borrowed, given, or earned money for students to pay for college expenses. Financial aid includes grants, scholarships, loans, and employment.

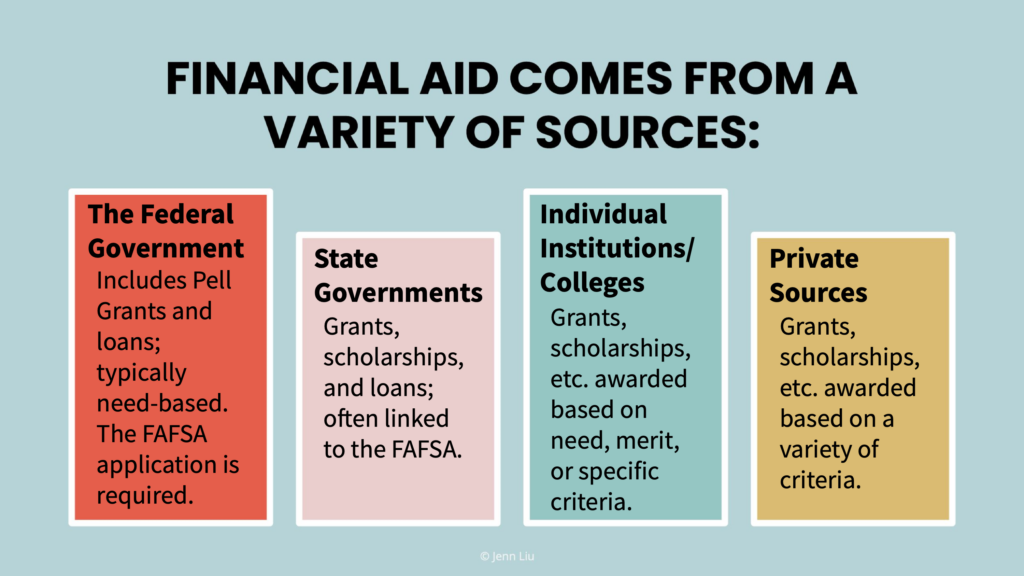

Sources of Financial Aid:

- Federal Government

- State Government

- Institutions/Colleges

- Private Sources

Types of Financial Aid:

- Grants: Free money students do not have to pay back; based on financial need.

- Pell Grants: Free money from the federal government awarded to students with exceptional financial need; all students who qualify are awarded (max=about $7400/year at the time of this writing).

- FSEOG: Free money from the federal government awarded by colleges to students with exceptional financial need; funds are limited and not all schools participate (max=$4000/year)

- Other Grants: Other free money including the Iraq and Afghanistan Service Grant, TEACH Grant, etc. Students should check with their colleges for more grants.

- Scholarships: Free money students do not have to pay back; based on different qualifications such as background, accomplishments, and experiences.

- Loans: Borrowed money; must be paid back with interest charged.

- Work-Study: Part-time jobs awarded to students with financial need.

The Cost of College Attendance:

- Direct costs: What students pay directly to their college (tuition, fees, room, and board)

- Indirect costs: Personal student expenses (books, transportation, personal care items, etc.)

I would also give students examples of tuition at different colleges, including private, state, and junior colleges, the different institutional scholarships available (e.g., WUE and merit-based scholarships), and resident vs. out-of-state tuition. For example, you could share how much financial aid students receive on average at different colleges. Did you know that at Yale, where tuition is $57,700, more than 53% of undergrads are awarded a need-based Yale scholarship with the average grant being over $55,100?

Important Tip: Highly encourage students to apply for their local scholarships! As one who has sat on scholarship selection committees and spoken with guidance counselors at different high schools, I know that there is less competition at the local level and sometimes hardly any competition at all with some scholarships! The bigger national scholarships (Gates Millennium, Coca-Cola, the SMART Scholarship, etc.) are worth a shot too, but they are very competitive.

Applying for Financial Aid:

Once students know the basics of financial aid and the college expenses they should expect, it’s important to explain what the FAFSA is and how to apply for financial aid. Here are some tips from the official FAFSA website. At the same time, I would share information about the CSS Profile. Click here for an overview.

If you would like all of the above information in a beautiful interactive Google Slides presentation with engaging pre- and post-questions included, click HERE!

A Google search can also provide you some great lists to share such as these:

States with Free Community College

Colleges with Full-Ride Scholarships

Finally, I would encourage students to start looking for scholarships early and keep track of scholarships they are interested in by using a spreadsheet or Google Doc. Here is a scholarship search tool from the U.S. Department of Labor, but there are also many other scholarship websites you could share.

Want to help your students really stand out? You know, like being able to say they started their own non-profit, small business, Youtube channel, or charity? Have them do Genius Hour Projects! Learn more HERE.

If you found this article helpful, share it with your teacher friends and colleagues!

Bold font